ad valorem property tax florida

Florida Statute 197374 allows for partial payments to be made on a current year tax for Real Estate or Tangible accounts. The statutory deadline for filing a timely exemption application is March 1.

Understanding Your Tax Bill Seminole County Tax Collector

Ad Valorem Taxes Ad valorem is a Latin phrase meaning according to worth.

. In accordance with 2017-21 Laws of Florida 119 Florida Statutes. They are a first lien against property and supersede governmental liens. PDF 125 KB Individual and Family Exemptions Taxpayer Guides.

Ad valorem and non ad valorem assessments are mailed on or before October 31 and due November 1. The most common real property exemption is the homestead exemption. Non-ad valorem assessments are also made on real property for essential services such as fire protection and garbage collection.

In Collier County Florida Ad Valorem or real taxes on real things according to their worth includes taxes on REAL ESTATE and taxes on a businesss Tangible Personal Property. Florida Statutes provides a number of ad valorem property tax exemptions which will reduce the taxable value of a property. Counties cities towns villages school districts and special districts each raise money through the real property tax.

Section 197122 Florida Statutes charges all property owners with the following three responsibilities. 4 if paid in November. Office of the Monroe County Tax Collector 1200 Truman Ave Ste 101 Key West FL 33040 305 295-5000.

Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide. We are committed to serving all citizens of Santa Rosa County in the most courteous professional innovative and cost-effective manner. Ad valorem taxes are levied annually based on the value of real estate property and tangible personal property.

CUSTODIAN OF PUBLIC RECORDS. The money funds schools pays for police and fire protection maintains roads and funds other municipal services. These tax statements are mailed out on or before November 1st of each year with the following discounts in effect for early payment.

Under Florida Statute 197 the Tax Collector has the responsibility for the collection of ad valorem taxes and non-ad valorem tax assessments. The Florida Department of Revenues Property Tax Oversight program provides commonly requested tax forms for downloading. Most forms are provided in PDF and a fillable MSWord file.

3 if paid in December. 2 if paid in January. A tax certificate is an interest bearing lien for unpaid real estate and non-ad valorem assessments.

The Tax Collector for Polk County is a proud member of the Florida Tax Collectors Association. Application for these exemptions must be made by. It includes land building fixtures and improvements to the land.

Florida property taxes are relatively unique because. As a property owner in Indian River County it pays to be informed about your rights and responsibilities under Florida law. Notice of ad valorem taxes and non-ad valorem assessments sample customer 123 main street 123 main st any town fl 12345-6789 lot 1 sample community taxing authority ad valorem taxes millage rate assessed value exemption taxes leviedtaxable value total millage total ad valorem taxes pay one amount only payment.

Steele Monroe County Tax Collector 1200 Truman Ave Ste 101 Key West FL 33040 The Monroe County Tax Collectors Office is. Taxes are paid in arrears beginning on November 1st of the tax year. There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property.

Real property is located in described geographic areas designated as parcels. Any changes to the tax roll name address location assessed value must be processed through the Lake County Property Appraisers Office 352 253-2150. Ad Valorem is a Latin phrase meaning According to the worth.

These are levied by the county municipalities and various taxing authorities in the county. In cases where the property owner pays their real estate. The Tax Collector consolidates the certified ad valorem and non ad valorem tax rolls and mails tax notices to the property owners last known address of record as it appears on the tax roll.

Therefore if for whatever reason the property owner fails to receive a tax bill it is the property owners. We are committed to meeting all legal requirements to our public business and government customers by collecting and distributing taxes license fees and information in a prompt and accurate manner while supporting a. The ad-valorem taxes and non ad-valorem assessments.

Discount already deducted. Putnam County Property Appraiser In Florida Property Appraisers are independent constitutional officers duly elected from their counties of residence by their fellow citizens and taxpayers. Ad Valorem Non Ad Valorem Tax Collection.

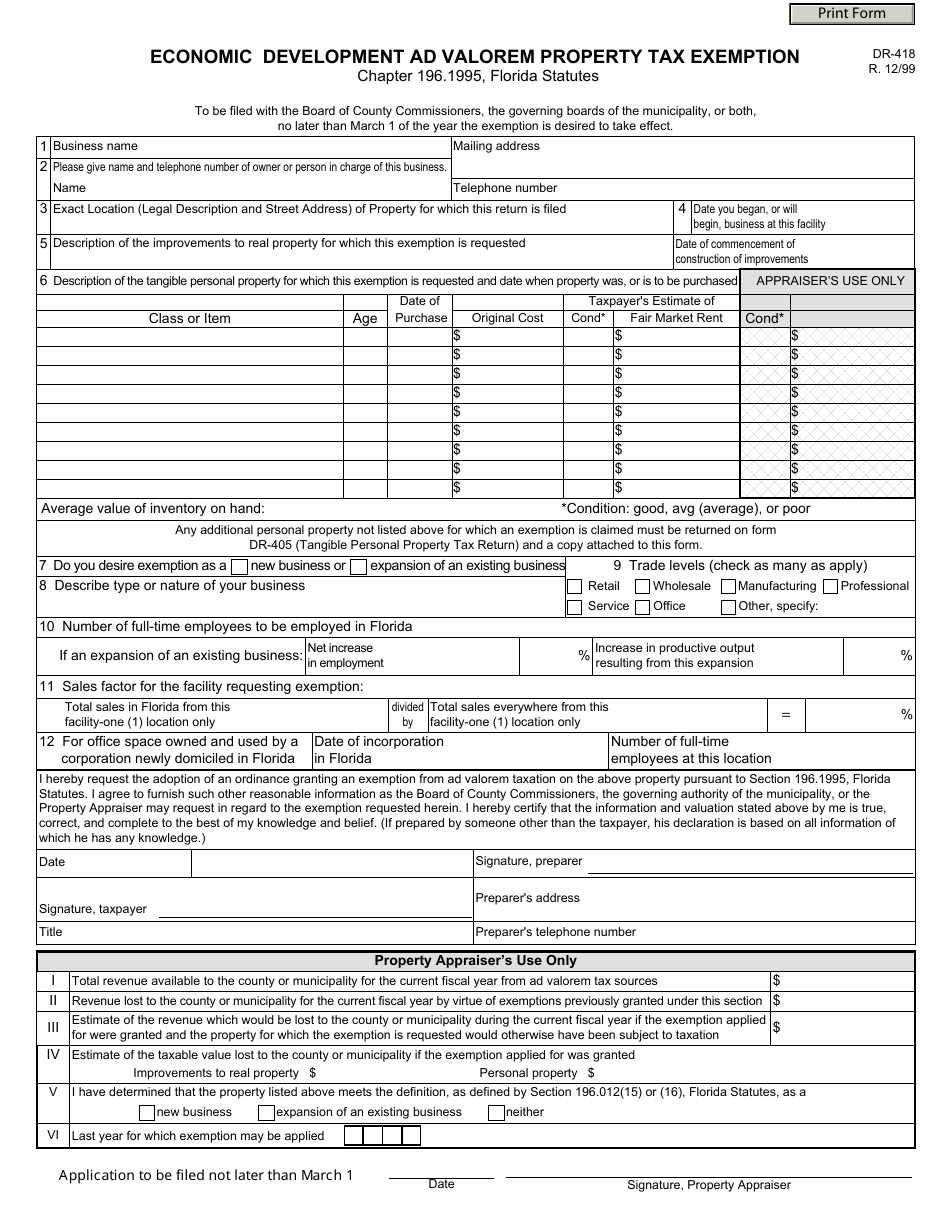

1299 section 1961995 FS PDF 446 KB DR-418C. Understanding the procedures regarding property taxes can save you money and will help this office to better serve you. Economic Development Ad Valorem Property Tax Exemption R.

1 the knowledge that taxes are due and payable. A tax certificate is a first lien created when a third party tax certificate holder or investor pays the outstanding delinquent taxes on a property. Beverly Carter CFE FCRM Records Management Liaison Officer beverlycarterputnam-flgov.

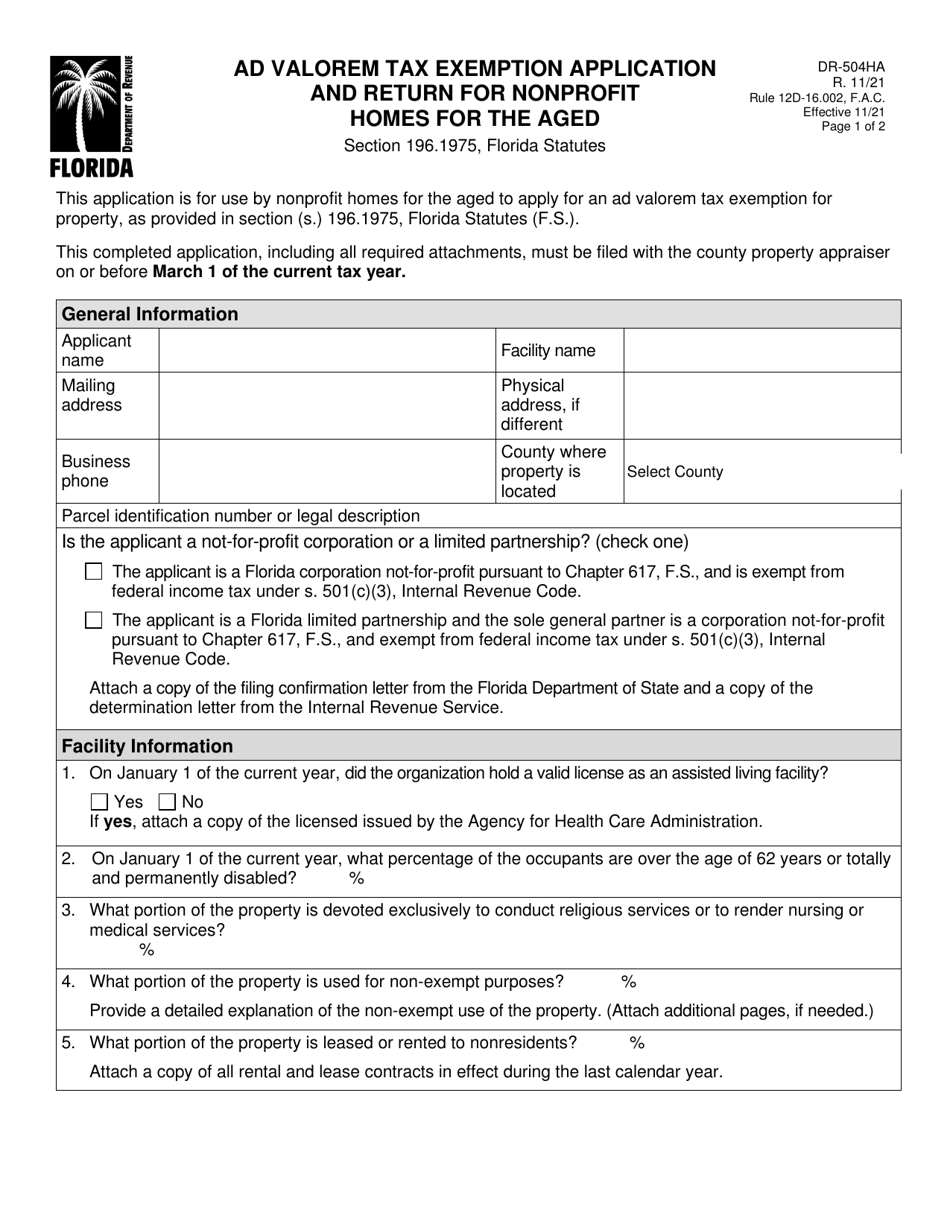

Ad Valorem Tax Exemption Application Return for Charitable Religious Scientific Literary Organizations Hospitals Nursing Homes and Homes for Special. According to Chapter 197122 Florida Statutes it is the taxpayers responsibility to ensure that hisher taxes are paid and that a tax. Ad-valorem taxes are based on the value of the real estate and any.

Ad Valorem taxes on real property is collected by The Tax Collectors office on an annual basis beginning November 1st for the year January through December. Ad valorem taxes are based on the value of real property for the tax year beginning January 1st to December 31st. Tangible personal property tax is an ad valorem tax assessed against the furniture fixtures and equipment located in businesses and rental property.

Florida law provides for a number of ad valorem property tax exemptions which will reduce the taxable value of a property. The most common real property exemption is the homestead exemption. Payments accepted in our offices by Cash Check Debit Card Visa MasterCard.

Property tax millage tax is an ad valorem tax that an owner pays on the value of the property being taxed.

Form Dr 462 Download Printable Pdf Or Fill Online Application For Refund Of Ad Valorem Taxes Florida Templateroller

Do Not Miss Your Opportunity To Save It Is Due By March 1st The Florida Homestead Exemption Reduces The Taxable Va Miami Realtor Miami Real Estate Florida Law

Explaining The Tax Bill For Copb

Form Dr 418 Download Fillable Pdf Or Fill Online Economic Development Ad Valorem Property Tax Exemption Florida Templateroller

Appealing Ad Valorem Tax Assessments Johnson Pope Bokor Ruppel Burns Llp

A Guide To Your Property Tax Bill Alachua County Tax Collector

Free Form Dr 462 Application For Refund Of Ad Valorem Taxes Free Legal Forms Laws Com

Property Taxes Common Questions Sarasota Fl Sarasotadavid Om

Tax Prorations Explained For Florida Real Estate Closings Part 2

Property Taxes Highlands County Tax Collector

Desoto County Property Appraiser David A Williams Cfa Arcadia Florida 863 993 4866

Real Estate Taxes City Of Palm Coast Florida

Real Estate Property Tax Constitutional Tax Collector

Broward County Property Taxes What You May Not Know

Form Dr 504ha Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Nonprofit Homes For The Aged Florida Templateroller

What Is This Trim Notice I Received From The Property Appraiser Lubin Law Property Tax Appeals South Florida